The cost related to organ donor’s treatment is covered only from the time the donor is admitted to hospital for transplantation surgery, the organ is harvested (removed) and till the time the donor is discharged upon recovery. Such transplantation should be medically advised and approved by law.

The policy however will not cover:

- Cost of the Organ.

- Payments for tests or screening for donors to ensure his organ matches.

- Tests carried out to assess insured's fitness for transplantation.

- Any payments to a government body for getting approval for transplantation.

- Any pre or post hospitalization costs related to donors.

- Any complications arising out of transplantation to the donor.

- Also, if the donor has undergone the transplant voluntarily then he/she will not be covered by their medical policy.

A comparative analysis of policies that cover organ transplant shows that neither are the coverages across plans similar, nor does any one plan provide complete cover. In some plans it’s an inbuilt cover whereas sometimes it has to be selected as a special benefit upon payment of additional premium.

The irony is, the donor is neither covered fully in the recipient’s (Insured’s) policy nor in his personal medical insurance.

Insurance companies now cover not only our health coverage but also the costs associated with mental illness. Depending on the policy, some companies provide coverage up to the policy's sum assured while others only offer coverage up to a certain amount.

There are differences between companies in terms and conditions as well as waiting periods for Psychometric coverage.

The Insurer pays only when :

- Illness is covered under the definition of mental illness.

- Hospitalization is in a Mental Health Establishment.

- Hospitalization is as advised by a Mental Health Professional.

- Mental conditions associated with the abuse of alcohol and drugs are excluded.

- Mental Retardation and associated complications arising therein are excluded.

- Any kind of Psychological counseling, cognitive/ family/ group/ behavior/ palliative therapy or other kinds of psychotherapy for which hospitalization is not necessary is not covered.

None of the sciences have had a steeper trajectory of improvements as compared to medical sciences.

The regulator now allows coverage of

- Uterine Artery Embolization and HIFU

- Balloon Sinuplasty

- Deep Brain stimulation

- Oral chemotherapy

- Immunotherapy- Monoclonal Antibody to be given as an injection

- Intravitreal injections

- Robotic surgery

- Stereotactic radiosurgery

- Bronchial Thermoplasty

- Vaporization of the prostate (Green laser treatment or holmium laser treatment)

- IONM – (Intra Operative Neuro Monitoring)

- Stem cell therapy: Hematopoietic stem cells for bone marrow transplant for hematological conditions are covered.

While this indeed is good news on the medical front and for patients, the fact that such treatments can cost you an arm and a leg isn't good news.

Many insurers who do cover Modern treatments under the regulators behest do so by applying sub-limits to the coverage. This dilutes the entire purpose of opting for such a cover.

Hence we need to ensure that our Health Insurance is covering these treatments without any sublimits.

Initially only allopathic treatments were covered under health insurance policies. In 2012, as per a circular from IRDA, Ayush treatments were allowed to be included in health insurance coverage. Currently there are more than 15 insurers providing health insurance cover for Ayush treatment either as an additional rider or as inbuilt cover.

As per IRDA, “AYUSH Treatment refers to the medical and/ or hospitalization treatments given under ‘Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homeopathy systems. The IRDA Definition is simple enough to understand. Let's know its impact.

Impact: Although IRDA has granted permission to cover non-allopathic treatments, there are certain limitations as follows.

The treatment has to be done at a Govt. Hospital, or in any Institute recognized by Govt. And/or accredited by Quality Council of India or National Accreditation Board on Health. There are more than 3600 such hospitals all over India.

Cashless facilities are not available under such treatments.

Most insurers apply a capping or sub-limit for such treatments

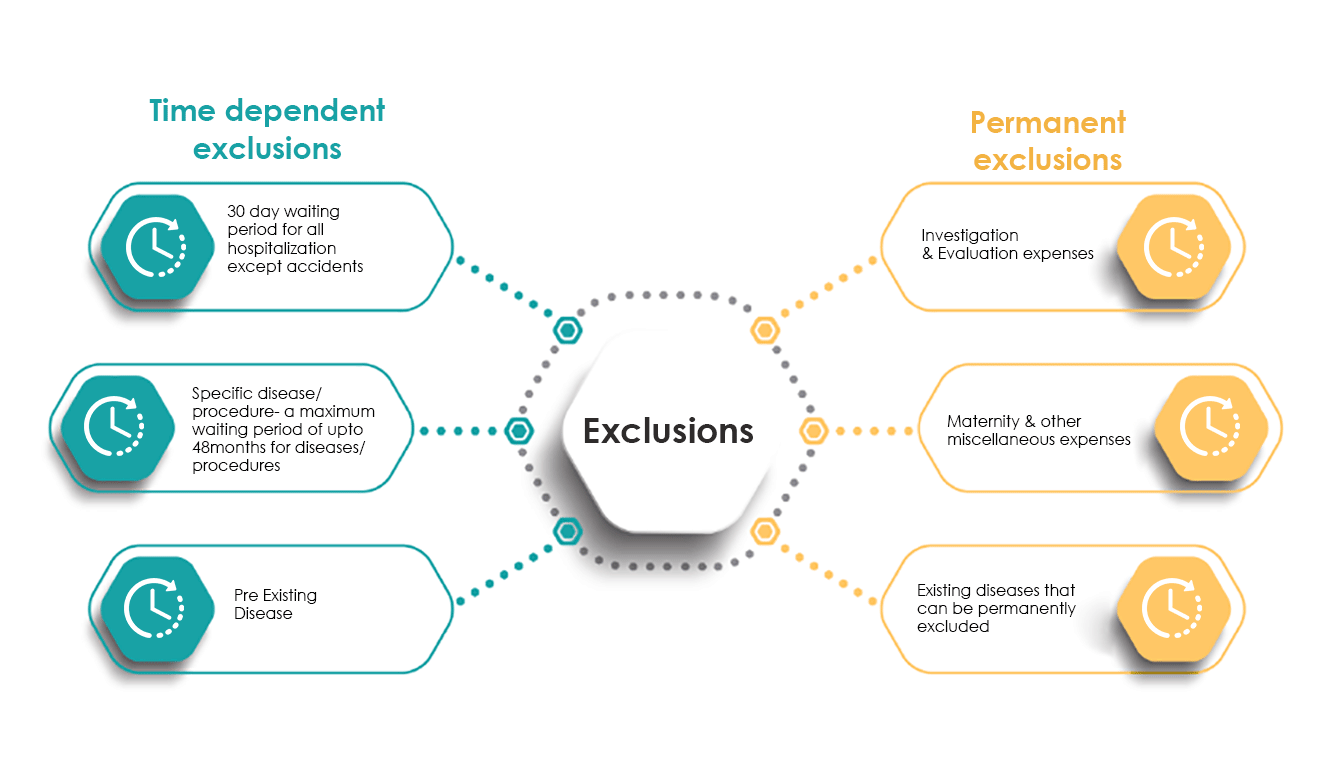

Generally speaking, PED form the most number of contentious cases that are heard by the Insurance Ombudsman.

IRDAI defines PED as a condition/ ailment/ injury/ disease which was either diagnosed or treated not before 48 months from issuance of a policy. General insurance practice is to cap PED’s at 3 to 4 years.

IRDAI also allows for carrying forward of this benefit when you decide to port the policy - the number of years of PED waiting period gets reduced from your incoming insurers policy by the number of continuous years you have spent with your outgoing insurer.

The 30 day waiting period clause. This clause is meant to protect the Insurer from Customers with ill-natured intent - Customers buying insurance policies after they know they are going to need hospitalization in the near future doesn’t sit well with the principles of insurance.

That said two exceptions to the rule are

- Claims arising out of an accident - the Insurer is liable for a claim if you have made the premium payment at the thier office and have an accident on your way home.

- Policies that are being ported in - this is a benefit that accrues to the policy holder by virtue of having already borne the 30 day waiting period with an earlier insurer, when she had bought the policy for the first time.

Most Health Insurance policies will consider a claim only when the hospitalization is more than 24 hours. Advancement in technology and medical sciences has however brought down the amount of time one needs to spend in a hospital considerably. This in turn was leading patients into getting hospital stays extended or their bills forged, all of which was neither in the interest of the insured or the insurer.

Insurers have therefore, on IRDAI's behest, curated a list of Day Care Procedures which allow for medical coverage even if the duration of hospitalization is less than 24 hours. There are more than 580 Day Care procedures and the extent of coverage differs from insurer to insurer.

The best approach when planning a day care procedure is to get it vetted from your insurer beforehand.

This clause, like the earlier one, gives an Insurer a sense of surety that a Customer isn’t buying a policy to make a claim, in the immediate future.

One of the principles of Insurance from a Customers perspective is to have a policy but to act like she doesn’t have one i.e. an individual is expected to take care of her asset (in this case her health) like she doesn’t own a policy.

IRDAI doesn’t mandate the number of years that an Insurer can prescribe as a waiting period, but does cap it at 4 i.e. none of the waiting periods in a policy can exceed 4 years.

The general industry practice is to club all non life-threatening hospitalizations like Cataract, Kidney Stone, Hernia into one bucket and cap the waiting period for such hospitalizations at 1 or 2 years, and life-threatening hospitalizations into another bucket and cap these at 2 or 4 years.

Your policy will specify the hospitalizations (broadly if not specifically) and the bucket that these would go under.

In case the specific disease mentioned under the waiting period is pre-existing, then it will be covered after the completion of the waiting period specified for pre-existing conditions.

There is a waiting period of 90 days to cover the newborn. However, many insurers cover a new born baby from day 1 within the maternity limit or overall sum insured limit.

The waiting period for maternity claims varies from 2 to 6 years in various plans available in the market. There are a couple of plans which provide a 9-month waiting period for maternity but the premium is so high that it is as good as creating a reserve from our own funds.

Having this coverage has come as a blessing in the case of Covid-19. During the Covid-19 pandemic, almost half of the population of India has faced a shortage of beds in hospitals, and the onset of domiciliary care has been a "Blessing in Disguise". This is because an insured with a domiciliary cover can take treatment at home if the condition that needs treatment would otherwise have required hospitalization, provided that either:

- The attending Medical Practitioner confirms that the Insured cannot be transferred to a Hospital or

- The Insured is able to substantiate the unavailability of hospital beds.

Any outpatient costs like Doctor Consultations, medicines, health tests, taken before or after the Inpatient Hospitalization, can be covered under Pre-Post Hospitalization cover.

However, these expenses should be pertaining to the same treatment for which the main medical claim is accepted.

Insurance companies put a cap on these expenses, usually expenses incurred within 30/60 days respectively for pre and post hospitalization.

For some treatments like domiciliary, maternity and organ donor cases, the pre and post hospitalization cover is not applicable.

Some insurance companies put additional caps like 1% of Sum insured on these expenses. Some disallow physiotherapy expenses under pre and post hospitalization.

It is advisable to check the policy for such finer details before purchasing.

Any outpatient costs like Doctor Consultations, medicines, health tests, taken before or after the Inpatient Hospitalization, can be covered under Pre-Post Hospitalization cover.

However, these expenses should be pertaining to the same treatment for which the main medical claim is accepted.

Insurance companies put a cap on these expenses, usually expenses incurred within 30/60 days respectively for pre and post hospitalization.

For some treatments like domiciliary, maternity and organ donor cases, the pre and post hospitalization cover is not applicable.

Some insurance companies put additional caps like 1% of Sum insured on these expenses. Some disallow physiotherapy expenses under pre and post hospitalization.

It is advisable to check the policy for such finer details before purchasing.

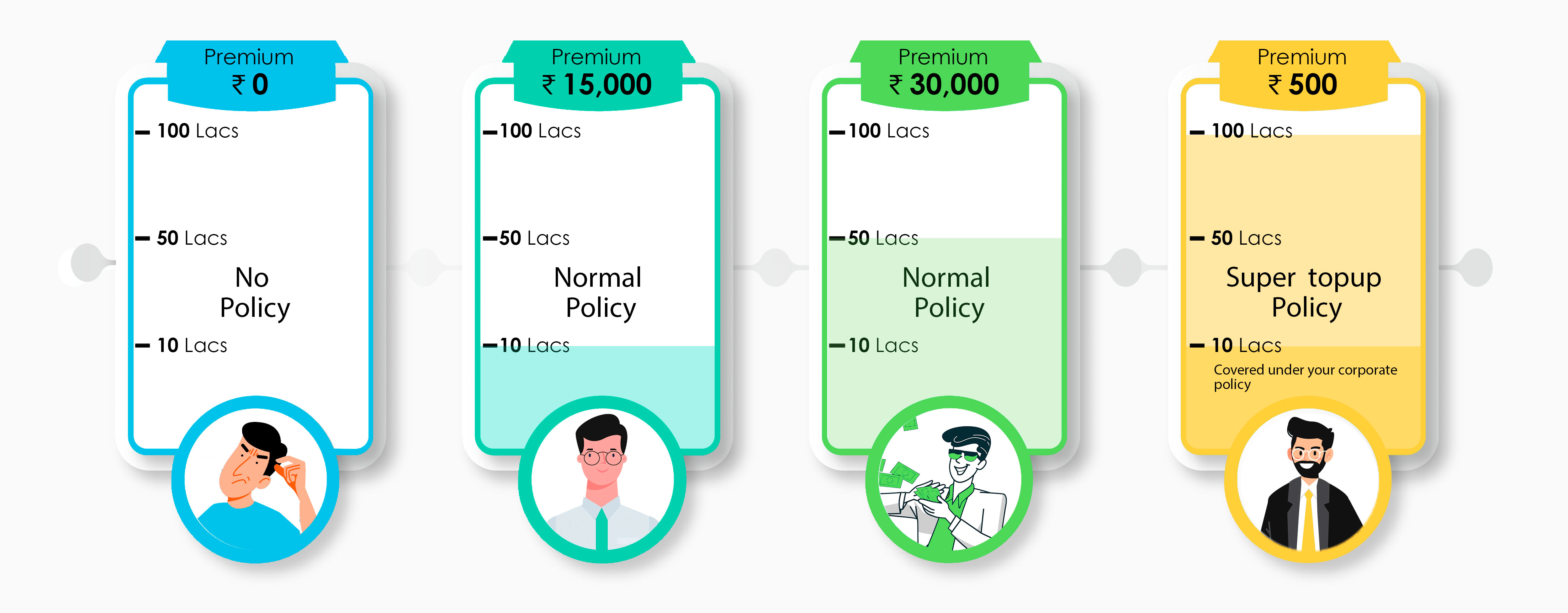

In simple terms, if your policy has a co-payment of 20%, then 20% of the admissible claim is supposed to be paid by you and the rest 80% is paid by the insurance company.

Deductible is a little different, in the sense that it specifies the amount that the insurer will deduct before it makes payment to the Insured. For example,

If Co-payment is 20%, then the claim amount payable by the insured is 20% and the rest 80% will be paid by the insurer.

If the deductible is Rs.25000 rupees, and the claim is around Rs.100000, then the amount paid by the insurer is 75000 only. If the Claim amount is less than the deductible, then no claim is payable by the insurer.

Both copayment and deductible are applied to the final claim (admissible claim) amount and not to the reported claim amount.

The option of co-pay is useful if you are already covered by some other insurance like the one provided by your company.

In case of any claim, the copayment or deductible amount can be claimed under your group policy and the rest of the amount can be claimed under your individual policy.

If you are in the process of buying a new policy, you can choose the appropriate copayment or deductible to bring down your overall premium amount.

Copayment is generally linked to the geographical areas of treatment, age of the member, usage in some non preferred hospitals or some specific diseases.

Get a free review of your

Get a free review of your

Medical Inflation

Medical Inflation New Diseases

New Diseases New Medical

New Medical