Category: Health Insurance

“A stitch in time saves nine” is a most popular idiom which aptly matches to “Now insurance for health saves your wealth”. It has been paradoxical thinking that health insurance must be taken only for old people but the fact is Health Insurance should be taken in teens. It’s been thought that health insurance an expenditure but with continuous changes in the environment and economy, healthy living has become luxury and health insurance has become a major rescue. Here are four major reasons why this is the right time for health insurance:

The Cost of Waiting: Understanding the Risks of Not Having Personal Health Insurance

Personal health insurance was seen as a product that should be purchased at the time of illness, and people used to wait for a certain period of time before taking a personal health insurance policy. It is detrimental to wait before taking the personal health insurance policy as it can have many mental and financial […]

How Technology is Changing Group Health Insurance?

Do you still use telegrams when you need to deliver urgent messages? Do you use a bullock-cart pool to work? When was the last time you plugged in a cassette or backed up your laptop on floppy discs? Better still, how about a dial-up connection for all your internet needs? No no don’t worry I […]

Co-payment in Health Insurance

What is Co-payment? Co-payment refers to the amount of claim that should be borne by the insured during the settlement of a claim. The co-payment amount depends on the co-payment clause mentioned in the policy. Irrespective of the claim amount, the insured has to settle their part before the insurance company makes the final payment. […]

Understanding Group Health Insurance for Large Companies: Self-Funded vs Employer-Funded Plans

Group Health Insurance Group health insurance for large companies can be an essential element of their employee benefits package and would benefit employees tremendously. Such policies cover hospitalization expenses incurred during an accident, illness or disease covered under their policy period – this ensures no surprise bills. Group health insurance premiums may be paid either […]

Have You Considered These Things Before Making a Health Insurance Claim?

The most important part of the insurance utilization process is claim settlement. Claim settlement can be considered as the last stage in the process and is the core stage for which the policy is taken. Health insurance claim settlement arises once the patient is hospitalized due to an accident, disease, or illness. Health insurance claim […]

Comparing Group Health Insurance Plans: How to Choose the Right One for Your Business

Group health insurance is a customized policy that can be designed per the insured customer’s needs and requirements. Still, the offerings vary from one insurance company to another. For instance, one insurance company might cover the robotic treatments, whereas the others might have it under exclusions. The basic covers such as sum insured, in-patient/out-patient/daycare hospitalization […]

Group Health Insurance vs. Individual Health Insurance: What’s the Difference and Which is Best for Your Business?

Businesses would often be confused when deciding the health insurance for their employees. It would be difficult to decide whether to go with group health insurance or individual health insurance. Group health insurance has certain benefits, such as customization of policy, one policy for all, no sub-limits, no co-payments, no restriction on the number of […]

The Hidden Benefits of Personal Health Insurance

Customers should explore many hidden benefits in personal health insurance plans to avail of benefits during the policy period. These benefits would be hidden in plain sight for the customers, and most would not pay heed to these benefits in the first instance. Insurance intermediaries would also not explain these benefits to the customer while […]

The Impact of Group Health Insurance on Employee Wellness and Productivity

Group health insurance increases employee wellness and productivity to a certain extent while keeping the other factors constant. Employee productivity cannot be measured directly as it involves many factors contributing to an employee’s productivity. These factors could be organizational culture, perks and salary benefits, job role, team cohesion, reporting supervisor, and employee benefits such as […]

Personal Health Insurance vs Employer-Sponsored: Which is Right for You?

Personal Health Insurance The personal health insurance policy, which is also referred to as retail health insurance or individual health insurance, pays for medical expenses of an insured client because of an accident, sickness, or illness in excess of the sum insured maximum in exchange of a small fee. The insured customer would completely own […]

Framework for Structuring the Group Health Insurance Plan for your Employees

Framework for Structuring the Group Health Insurance Plan for your Employees Let’s see the basic point to consider when designing an efficient plan: Focus on preventive health checks: Healthy employees make for a healthy workplace. Timely health screenings of employees are important not just for the wellness of the employees but also for the growth […]

Death claim in Insurance – Execute A Will For Your Nominee To Get The Proceeds Of Your Insurance Claim After Your Death

Like thousands of people, do you think that the Nominee will get the proceeds of your Insurance Claim after your death? Then you are mistaken. The nominee is just a custodian of the claim amount. He can’t spend the amount. He will have to give the proceeds to the legal heir as per the succession […]

How Easy is it to Port your Group Health Insurance Policy?

Ravi Kumar, an IT professional in his late forties walked into the office of a general insurer. He was not happy with the way his current insurer had treated his health claim; they had kept dilly-dallying the processing for a couple of months, asking for additional documents every time he submitted the previous ones, and […]

Do You Really Need Insurance Broker for Group Health Insurance ?

Finding a well-planned and comprehensive Employee Benefits Program for the employees can be a real challenge and that’s why insurance helps in designing a well-structured benefits program so that the right people continue to work for an organization. Furthermore, the whole customer experience in group health insurance or group mediclaim is driven by a triad […]

Covid-19 Health Insurance Policies Comparison

Insurer Eligibility Age No Travel Benefit Type Sum Insured Premium (Rs) Other Benefits Digit Group Policy (with Flipkart) 18-60 Yrs Last 30 days Indemnity 3L & 1L 1267 511 1. 30& 60 Days pre & post Hospitalization 2. No room rent capping 3. Ambulance Assistance 1% ICICI (with PhonePe & Flipkart) 18-75 Yrs After 31st Dec […]

Does Covid 19 gets covered under Workmen compensation Insurance policy?

If you are already covering your workers under ESI then the workmen compensation policy is not applicable. The compensation and treatment cost of the disease will be as per ESI policy. For those cases where the workers are only covered under the Workmen compensation policy, you can read further. Workmen’s Compensation policy covers any worker […]

Covid 19 Coronavirus Insurance Policy in India

Coronavirus Covid 19 insurance policy has been introduced by the insurance companies to cover the hospitalization expenses incurred due to Coronavirus. There are two types of Covid 19 specific policies which cover the corona related expenses which are: Corona Kavach and Croona Rakshak. Covid-19 pandemic is covered under all the group health insurance policies in […]

Covering Employees Parents under group health insurance- 3 different cases

Covering Employees’ Parents under group health insurance- 3 different cases The premium payable is decided based on many factors and the most important among those is the previous year’s claims. With people who are aged and with a pre-existing disease it is very natural that the frequency of claims will be high and most of […]

How to Cover Parents in Group Health Insurance?

It is important to know whether the group mediclaim policy for parents is available in your organization. Parents’ health insurance premiums would depend on the age of the parents and the coverage required. Parents can be added at any point of time during the policy period. The premium can be paid by the employer or the employee.

Checklist for Employers Before Buying Group Health Insurance

Group health insurance is the most preferred form of health insurance policy among employers as a single policy would cover all their employees. The group health insurance policy can also be extended to cover the family members of the employees. The sum insured under the group health insurance can be offered on a floater basis […]

How to Cancel a Group Health Insurance Plan?

Group health insurance plans can be canceled due to various reasons from the customer’s end as well as the insurance company’s end. Group health insurance cancellation can be done during the free look period, for which the insurance company would pay the complete refund of premium subject to nil claims before the cancellation of the […]

Can the Insurer Decline to Renew my Health Insurance Policy?

Insurance policy renewal is the most important thing for any customer. Personal health insurance renewal would be done by the customer just before the expiry of the policy to prevent the policy from lapsing. Insurance renewal happens every year for most insurance products except for long-term insurance policies, where the insurance premium is paid for […]

Things to Consider While Buying Group Health Insurance for an IT Services Company

Different types of companies have different needs from their group health insurance provider. As an IT services company, it can be confusing to find the right insurance product that meets all your needs. This can be especially difficult since there are so many insurance products to choose from. However, with the right guidance, the process […]

The Biggest Problem with Group Health Insurance- Advantages and Disadvantages, and How You Can Fix It?

If you are looking for a group health insurance plan, we hope you have read our guide to the pros and cons of different types of health insurance plans available on the market today at Health Insurance Company (HIC).

Best Health Insurance Policy in India

‘He who has health has hope; and he who has hope has everything’- Thomas Carlyle The above quote holds even more true in today’s world. People, especially after the corona pandemic have realized that the best investment to put in, is our own health. The best health insurance policy depends holistically on every individual’s needs […]

List of 15 Best Government Health Insurance Schemes in India 2022

Here is a list of health insurance schemes in India by 2022 offered by various state governments. This list also includes the Indian government schemes which cover the below poverty line families. Almost all the government health insurance schemes mentioned below are free health insurance schemes where the premium is borne by the state and […]

What are the Benefits of Super Top Up Health Insurance Plan?

A super se bhi upar health insurance plan! Once a 5 year old kid asked a gentleman, ‘Uncle what do you call super se bhi upar in English. The gentleman promptly replied, ‘Super- Top up’ because that gentleman was an insurance broker. Well, jokes apart, a Super- Top Up health insurance plan can come to […]

Should You Consider the Health Insurance Provided by Banks Under Group Health Insurance?

What, according to you, is the most valuable thing that is secured by banks? The answer surprisingly is “our Health”. Other than securing our valuables, banks also secure our health. But does this bank health insurance policy provide enough features and coverage? Let’s understand this, through a real-life incident that happened with Mr. Prateek and […]

The Art of Self-Regulation for the Insurance Sector

Time and again IRDA, the Regulator of the Insurance sector, has had to come down with a heavy hand to protect the Consumer (Insured) from getting entangled in a web of complexities that the consumer should ideally not have to contend with. Some time back, it had to intervene, to ask insurers to review claims […]

Annual Medical Check-up in Group Health Insurance for Employees

Group health insurance policy provides insurance protection to the employees of an organization enrolled under the same group health insurance policy. The medical checkup is a medical examination in the prospective applicant is required to undergo to provide an understanding to the insurance company regarding the acceptance of risk. A pre-policy medical checkup is a […]

All about Lockdown and its impact on Insurance

The impact is not the same for all the lines of insurance. Life insurance is staring at huge claims due to the sudden and increased number of deaths, whereas the increased risk of falling sick has made people more aware of it. We will look in detail at the impact on commonly purchased lines of […]

Personal Health Insurance: How to make it Affordable?

The personal health insurance premium is the amount paid by a policyholder to the health insurance provider. Other charges, such as deductibles and co-payments, can increase the cost of your overall health coverage premium.

6 Steps to Reduce Group Health Insurance Premium Cost

Cost-cutting is a hard reality, especially in the post-pandemic era. As an employer, you want to do what is best for your employees while not losing sight of your company’s long-term goals. For your company to run smoothly and have a sustainable future, you must look at all possible ways to reduce your costs. Your […]

4 Reasons to Buy Personal Health Insurance Over Group Health Insurance Plan

Personal health insurance policy compensates the insured in case of hospitalization due to illness, disease or accident up to the sum insured limit mentioned under the policy in return for a nominal amount known as a premium. Personal health insurance is also known as a retail health insurance policy. Personal health insurance can be taken […]

The Advantages of Having Personal Health Insurance in Retirement

Retirement refers to when one leaves an active profession and working life behind, often after age 60 or when no longer capable of work. People generally retire due to various reasons, including health conditions, relaxation, or aging in general – such as retiring due to incapacity. People typically enjoy peaceful retirements to focus on maintaining […]

Employee Retention, Attraction, and Satisfaction: The Benefits of Group Health Insurance

Group health insurance has several benefits, such as health insurance coverage in case of accidents, illness or diseases, daily cash benefits, coverage of organ donor expenses etc. In addition to these basic benefits, a group health insurance policy would also provide an additional advantage to the employers in the form of increased employee retention, new […]

Top 10 Cashless Health Insurance in India

Cashless health insurance is a type of health insurance claim settlement facility provided by the health insurance companies in which the health insurance claims would be settled directly to the hospitals without any customer intervention. The claim amount would be paid directly to the hospital in which the insured is getting treated. A cashless claim […]

Best Health Insurance Companies in India 2023

The most trusted health insurance company in India by 2023 will be the one that can offer top health insurance plans with more hospitals in the network, the highest rate of settlement for claims, the most efficient customer services, and an easy claim settlement. The best health insurance is the policy that provides the best […]

How to Save Money on Personal Health Insurance Coverage

Today, any minor surgery can cost you anywhere between 2-5 Lakh Rupees. Health inflation in India is rising at about 14% per annum. If you are a white-collar worker, your salary hike might have been lower than 14% per annum, especially over the last few years. Without basic health insurance, it is increasingly difficult for […]

Group Health Insurance: How to Demystify Room Rent and ICU Limits?

Room rent in group health insurance is the per-day room charges or bed charges the hospital charges the insured patient in case of hospitalization.

Social Security/Health Schemes for Poor by Government in India

Social security schemes are the schemes imposed and controlled by the Government to provide social benefits to the members of a community as a whole or of particular sections of the community. These include health schemes by the Indian government which would help the weaker sections to avail health care benefits in times of need. […]

Beyond the Basics: Uncovering the Hidden Advantages of Group Health Insurance

Group health insurance covers the hospitalization expenses of the insured members in case of illness, disease or an accident up to the sum insured limit mentioned under the plan. In addition to basic hospitalization, the policy also covers daycare expenses, expenses incurred on alternative treatments, organ donor expenses, outpatient expenses etc. These benefits are advertised […]

Understanding the Important Cost Considerations of Personal Health Insurance

Ever wondered how Insurers cost their Persona Health Insurance Products? While many statistics and related sciences are used. Let us Understand Some Factors Behind Deciding Premiums. Age: Age is an important factor in deciding the health insurance premium. All insurance corporations base their top rate calculations on the age of the eldest member within the […]

Types of Workers’ Compensation Insurance

While we give the best perks and benefits to our directors and CEOs, we ignore the basic benefits for our workers. They are the only breadwinners in the family. In addition to taking care of occupational safety, one should always value their well-being. We would rather call it Work-care compensation insurance? In this article, we […]

Common Misconceptions About Personal Health Insurance

Personal health insurance misconceptions are common among people intending to purchase health insurance. Misconceptions about personal health insurance could be due to various reasons like the influence of past events or bad experiences with the insurance provider. Such events create a strong negative feeling towards personal health insurance and prevent you from buying a policy. […]

A Healthy Bottom Line: How Group Health Insurance Can Boost Your Business’s Financial Health

Group Health Insurance The group health insurance policy is intended to pay for the medical costs of the insured in cases that they require hospitalization because of injuries, illness, or ailment within the period of the policy. You are covered up to your sum insured mentioned under the policy. Group health insurance is usually taken […]

Top 20 Reasons You Must Invest in Group Health Insurance for Small Businesses

If you’re a company, start-up, small business, or large organization of any kind, it is important to consider opting for group health insurance. A group health insurance, as the name suggests, is a health insurance policy that covers several people together. Hence, the entire staff or members of an organization can be covered within a […]

Endoscopic Sinus Surgery in Group Health Insurance

Sinusitis is a condition in which the cavity around the nasal passage becomes inflated. Sinusitis is caused due to inflammation or swelling of the tissue lining the sinuses. Sinuses are the hollow spaces within the bones between the eyes, and behind the cheekbones in the forehead. These sinuses make mucus which helps in keeping the […]

Group Health Insurance Portability

Health Insurance Portability:: Health insurance porting refers to the process of switching the health insurance policy from one insurance company to another without losing the accrued benefits such as waiting period credit, no claim bonus, free medical check-ups etc. Health insurance porting provides the customers with freedom to switch to a better insurance company in […]

Things You Should Know About Workmen Compensation Policy in India

Workmen Compensation policy premium calculator takes into account the minimum monthly wages of the employees and the number of employees. In addition to this, the workmen compensation policy premium calculator also takes into consideration the occupation of the employees. Workmen’s compensation policy can be purchased online with ease and better discounts can be obtained. What […]

5 Reasons to Offer Group Health Insurance to Your Employees

Group health insurance refers to health insurance that can be availed by a company for its employees. Group health insurance plans can have several advantages over personal health insurance plans. Further, providing group health insurance to employees can also benefit a company in a variety of ways. Nowadays, almost every company is getting on the […]

Policy and Checklist for Claiming Group Health Insurance Refund in India

A group health insurance policy compensates the members up to the sum insured limit mentioned under the policy in case of hospitalization due to an accident, illness, or disease. A group health insurance policy is usually taken out by the employer for his or her employees to provide health insurance coverage in case of hospitalization. […]

How to Pick an Affordable Group Health Plan for Your Start-up?

The importance of a health insurance plan is not unknown. As a start-up owner, one of the biggest questions you might be tackling is whether or not you should offer health insurance cover to your employees. A group health insurance plan, is a health insurance coverage offered to people working in the same organization. This […]

Modern Treatment methods and your Health Insurance

With rapid advancements in the field of medicine, every year, we see many new and modern methods of treatment being made available for the benefit of the people. Listed below are a few such Modern Treatment Methods: A. Uterine Artery Embolization and HIFU B. Balloon Sinuplasty C. Deep Brain stimulation D. Oral chemotherapy E. Immunotherapy- […]

How a super top-up health insurance plan can help you?

How a super top-up health insurance plan can help you? The only cost-effective way to protect against the current medical inflation and meet medical requirements is to have a Super top-up Health insurance policy. Serious medical emergencies can ruin our finances at any time, this can be only avoided with adequate insurance cover for our […]

Why is Health Insurance Important?

The pandemic has made the world realize that medical emergencies are unpredictable and can cause a financial catastrophe so huge that it would be impossible to bear the burden without the aid of insurance. Treatment in a private hospital can derail your finances, and it becomes more difficult if the breadwinner of the home suffers […]

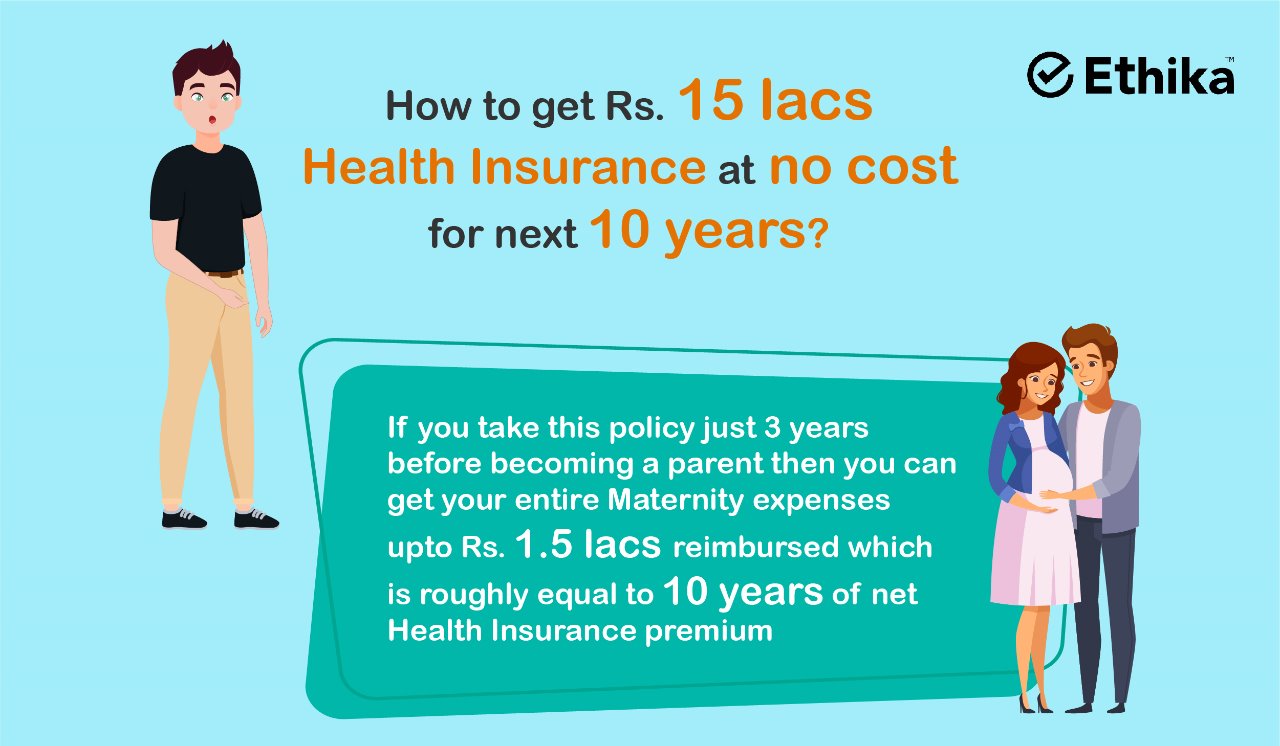

How to get your 15 lakh Health Insurance at no additional cost for the next 14 years?

Are you planning to get married? Are you prepared for the roles and responsibilities that come with it? Every milestone in your life brings more responsibilities. Manage them well with a beautifully designed health insurance policy that covers Maternity expenses up to Rs.1.5 lacs. If you take this policy just 3 years before becoming a […]

The Next Big Thing in Group Health Insurance for Startups

Before we talk about Group Health Insurance for startups, let’s talk about existing times. This is both one of the best and, ironically, one of the worst times to be alive. Wealth and health are faltering and building up at alarming paces, uncertainty is widespread. But you know what else is widespread – the spirit […]

What are the Tips to Choose the Best Health Insurance?

Choosing a well-suited health insurance policy from the many options available in the market could feel like a herculean task. You need to take into consideration many factors before making a purchase. But with so many confusing details, it is easy to get bogged down, and you may make a hasty decision and end up […]

Personal Health Insurance Glossary

Insurance involves a lot of technical terms that a layperson may not be aware of. However, it is important to be familiar with these terms as it helps you to understand the terms and conditions of a health insurance policy. Further, it helps to choose the right insurance policy for your needs. We’ve covered some […]

How are Group Health Insurance Premiums Calculated in India?

The higher the risk associated with an insurance policy, the higher the premium that the insurance company will charge. For example, the premium of health insurance for a twenty-year-old will be much less than the health insurance premium for a sixty-year-old. This is because the chances of a twenty-year-old contracting a serious illness are much […]

Health Insurance for Healthy people should cost zero

Nowadays health insurers are providing benefits to the insureds not only by bearing the medical expenses but also by adding options to the policy for their better health. Like a health coach Discount in the renewal premium for following any healthy habit and making a difference to their health. Especially in India, it’s difficult to […]

Health Insurance Claims – A Perspective

Health is Wealth. This is a saying which every one of us will agree and vouch for. However, it an unwelcome situation where the hard-earned wealth has to be spent to regain the health which got deteriorated for some reason or the other. It is from this concept that the ideology of Health insurance cropped […]

Organ Transplants and Health Insurance

The past few centuries have witnessed great strides in medical science with revolutionary medical breakthroughs. Be it the invention of vaccines and antibiotics or the more recent developments in artificial intelligence, advancements in the field of medicine have not only increased life expectancy but also helped improve the overall quality of human life. Organ transplantation […]

Health Insurance for Workers is made Mandatory by Government

In the guidelines released by the Ministry of Home Affairs, it has been made mandatory to have health insurance for workers when the restarting of operations starts on April 20th. Normally, in a factory or manufacturing premises, the workers are covered under Workmen’s Compensation for occupational hazards and not for medical insurance. Some workers covered […]

Tax Benefits in Personal Health Insurance

Personal health insurance is a type of insurance policy that provides hospitalization and other related expenses to the insured in case of treatment due to any illness or disease mentioned under the terms and conditions of the policy. The maximum amount of liability of the insurance company, in any case, would not exceed the sum […]

Claim Settlement Ratio in Group Health Insurance

Group health insurance claim is the claim raised by the members of the group health insurance policy. The claim under group health insurance policy can be raised on a cashless basis or reimbursement basis. In case of cashless claim settlement, the insurance company would directly settle the claim with the hospital whereas in case of […]

Maternity Benefits in Group Health Insurance Policy

Group health insurance is a customized health insurance policy in which the coverage can be customized as per the needs and requirements of the customer. Group health insurance policy covers the hospitalization expenses of the members due to any illness or disease as mentioned in the policy copy. The premium of the group health insurance […]

How to Write a Group Health Insurance Cancellation Letter?

Group health insurance cancellation letter is the letter written to the insurance company to cancel your group health insurance policy due to any of the reasons whatsoever. The group health insurance cancellation sample letter format is provided in this article for ready reference. The same format can be used to write the group health insurance […]

Coronavirus- The high impact on employee mental health

It’s no surprise that the Indian economy has taken a big hit post corona as the news arrives. The GDP of the country has contracted in double-digits, the lowest in decades. We have come from being the world’s fastest-growing economy to our GDP being lower than Bangladesh, the situation looks bleak for everyone in 2020. […]

How does Group Health Insurance Work?

A Group Health Insurance policy is a single umbrella policy that is offered to Companies and covers the health insurance needs of their employees. Most often this policy is offered as a benefit to the Employees by the Employer. The policy can be extended to the Employees’ Spouses, Dependent children & Dependent Parents / In-laws […]

Health Insurance Policies Which Cover out-Patient (OPD) Benefit

1. Aditya Birla – Activ Health Platinum Enriched Insurance Plan: i) Coverage: The policy will cover the costs incurred for medically necessary consultations, diagnostic tests, and pharmacy expenses on an outpatient basis up to the amount specified under the policy. The appointments can be scheduled through the website or through the mobile application or call […]

How to Pickup an Affordable Group Health Plan for your Startup?

How to Pickup an Affordable Group Health Plan for your Startup? It’s an acknowledged fact that hiring for a start-up is a challenge that every entrepreneur’s (especially first-time ones’) headache is centered around. Attracting a settled and performing individual to leave all behind and jump ship (more like jump ship to the boat) is hard […]

Terms & conditions in Health Insurance Policy Should not be used for Marketing Tactics

When it’s a question of simply pooling the money for one who would actually incur a loss, then why are there so many terms and conditions? Why can’t it be as simple as that? In the case of hospitalization, the total bill amount up to the sum insured is payable? All I want to say […]

Sum Insured vs. Sum Assured in Group Health Insurance

Before you choose a group health insurance for your company, it is important to research the difference between insurance policies. Insurance policy documents contain several technical terms that a policyholder needs to understand. Two commonly used terms are “sum insured” and “sum assured”. Understanding what the two are and the difference between sum insurance and […]

Individual Health Insurance Plans for Senior Citizens in India

Senior citizen health insurance is a contract between the insurance company and the insured customer in which the insurance company agrees to settle the health insurance claim of the insured up to the sum insured limit for any insured illnesses or disease excluding the copay for each and every claim, in return for a nominal […]

Tax Benefits in Group Health Insurance

Group health insurance offers health insurance coverage to a group of members under a single master health insurance policy, usually a group of employees of an organization. Group health insurance providers cashless or reimbursement claim settlement facility to the members of the policy in case of hospitalization due to any illness or disease. The major […]

How to Write a Personal Health Insurance Cancellation Letter?

Personal health insurance cancellation letter is the letter written to the insurance company by the insured customer to cancel his/her personal health insurance policy due to any of the reasons whatsoever. The personal health insurance cancellation sample letter is provided in this article which can be used to intimate the insurance company regarding your personal […]

List of Medical Expenses covered under Group Health Insurance policy

Group health insurance policy is a type of health insurance policy under which the hospitalization expenses of the insured member are covered up to the sum insured mentioned under the policy. Group health insurance policy is usually taken by organizations to provide health insurance cover to their employees working in the organization. Do look at […]

11 Reasons Why You Should Invest in Group Health Insurance

Have you ever noticed how inadvertently the word ‘Group’ and all its applied implications, connotations, make such a huge part of our lives? No matter how you look at things whether you identify as an individualist or a conformist. We are all at the end of the day a part of something or the other […]

Things to Consider While Buying Group Health Insurance for the Manufacturing Company

Purchasing group health insurance for your employees can be a complicated process. Every company is unique and its requirements and needs are different. The health insurance needs of a white-collar advertising company will be different from a primarily blue-collar manufacturing company. If you run a manufacturing company, then there are certain key aspects that you […]

How to Negotiate for Billing while in hospitalization without Insurance

The commercialisation of health care is a burning agenda today. There is no regulation on hospitals and hence we don’t have anything like MRP or say standard rates for hospital procedures. Negotiating with the art of negotiation under the assumption that there is no medical insurance.

How to be prepared to have hassle free treatment & claims process in personal health insurance

An insured purchases a personal health insurance policy after a thorough understanding and comparison. But the job does not end there. A health insurance policy is a good deal only if you get your claim settled hassle-free. But the insurance company alone is not responsible for getting this done for you. There are a couple […]

How to Control the Claims in Group Health Insurance?

How to exercise claim control measures in group health insurance Group Health Insurance premiums in the Indian market are very competitive compared to the world market and have been driven more by prior year premiums than claims experience. As a result, organizations and employers have had a good ride, as they were able to pass […]

Group Mediclaim to Personal Health Insurance Portability

The insurance regulator has permitted the porting of health insurance. Here are the guidelines for converting group health insurance to individual health insurance: If an employee wants to port the policy to a personal health insurance policy from the group policy, he can do so, at the time of exit from the company. The employee […]

How Should Start-ups get Group Health Insurance?

This is the most frequently asked question by startup founders. Though it is not mandatory to offer Group Health Insurance to the Employees for white-collar Employees, the organizations provide this as a benefit to the Employees as every other organization is doing so. Employees expect to get Health Insurance benefits from the Employer, as it […]

How to Add or Delete Employees in Group Health Insurance?

Group health insurance is usually provided by companies as a benefit of employment to employees. Depending on the company, the employees may pay a discounted rate for their insurance or get health insurance completely free of cost from their employer. After opting for group health insurance, companies and employers can have several questions about how […]

How to Maximize Your Personal Health Insurance Benefits?

A personal health insurance policy is typically used to pay for the costs of medical treatment for the insured if they are hospitalized due to illnesses or accidents. But other benefits can be derived from personal health insurance plans that are unknown to many users. Health insurance plans come with many benefits, some of which […]

The Cost of Doing Business: How Group Health Insurance Can Help You Save

There are numerous costs involved in conducting business in India. These include startup costs, sunk costs, and employee expenditures such as salaries, employee benefits etc. The major costs apart from the initial investment would be the operational and employee benefits costs. Any business would like to reduce its costs in one way or the other […]

Navigating the World of Group Health Insurance: Tips for Choosing the Right Plan

Group Health Insurance covers the medical expenses of the insured members up to the sum insured mentioned under the plan in return for a premium amount that the insured customer pays. Group health insurance can be classified as employee-employer and non-employee-employer. Most group health insurance plans belong to the employee-employer segment, where the employer would […]

5 Benefits of Investing in Personal Health Insurance

When a person is hospitalised as a result of an accident or illness, personal health insurance can be helpful. Personal health insurance policy can be purchased for oneself as well as someone you have an insurable interest in. Insurable interest in simple terms is your interest in the person you are insuring. You can therefore […]

10 Reasons Why Group Health Insurance is a Game-Changer for Small Businesses

Group health insurance provides health insurance coverage for all the members insured under a single policy. The employer generally pays the premium for Group health insurance. Small-scale businesses form the foundation of our economy because they offer local jobs, thus contributing to our local economies. Of late, there has been a renewed thrust towards developing […]

How to Choose the Right Personal Health Insurance Plan for You?

Tips to Choose the Right Personal Health Insurance Plan Personal Health Insurance Plans are those in which the insured pays the premium to cover their financial expenses in case of any hospitalization. It is essential to choose the right personal health insurance plan as it would be difficult to change the health insurance policy every […]

The Importance of Personal Health Insurance: A Guide for Young Persons

Personal Health Insurance Covid -19 has accentuated the need to have health insurance. Health insurance not only gives financial stability to the policyholder by safeguarding their hard-earned money, but also protects the policyholder’s monies, which she would have otherwise had to bear due to hospitalization. Personal health insurance also known as retail health insurance can […]

Things You Must Ask from Your Insurance Broker before taking a Group Health Insurance Plan

A group health insurance policy covers a group of people under a single policy removing the need to take individual policies, in simple words group health insurance policy is a master policy which has the details of all the insured members. It is beneficial for customers to take group health insurance from an insurance broker […]

Which one is better to opt – Retail Health Insurance or Group Mediclaim

Look at the this comparison that will help you understand the difference between group and retail health insurance.

Difference between Network and Non-Network Hospitals?

The network hospitals have a dedicated insurance desk to help the customers have the health cards of the group health insurance or retail health insurance.

Non-network hospitals are those that are not tied up with the insurance company and cannot offer cashless claim settlement services to the customers of the insurance company.

How to Choose Cheap Group Health Insurance? (₹ 50 Lacs cover at ₹ 500)

A group super top-up plan is a type of health insurance plan which can be taken in addition to the base group health insurance plan at the lowest possible premium. Cheap group health insurance in India is available online from Ethika insurance broking here.

Employee State Insurance Corporation Schemes (ESI Scheme): Benefits & Eligibility

The Employees State Insurance Corporation (ESIC) is a statutory body under the Ministry of Labour and Employment, Government of India. Employees earning less than Rs.137 per day are exempted from payment of their contribution.

How and Why to Switch From ESI To Group Health Insurance?

To switch from ESI to group health insurance, you need to enroll in the ESIC scheme twice a year and go through the group health insurance purchase process once a year. The minimum requirement of group health insurance is 7 lives, which is less than that of ESI.

What is a Cash Deposit Balance in Health Insurance?

In health insurance, a cash deposit balance account is like a bank account where the insured can put his premium money. This money will be used in the future to cover employees’ health insurance costs.

Risk Pooling: Reduce Risk in Group Health Insurance Selection

The insurance company acts as an intermediary between a group of people who would like to hedge their risk by taking the insurance and paying the premium. A health insurance policy should be taken by healthy people as well as unhealthy people so that the loss ratio could be maintained by the insurance company.

Five Reasons to Offer Group Health Insurance to Your Employees

In this article, we’ll discuss five of the best reasons to buy group health insurance for your company:

Who is TPA: Third-Party Administrator in Health Insurance?

Insurance companies outsource the claim settlement part to the TPA to reduce the cost as it would take much of the time and manpower of the insurance companies.

How Can Group Health Insurance Reduce Employee Attrition? How to Reduce Employee Turnover?

In developed countries such as America, Canada, and Europe most employees check the health insurance coverage offered by the employer before deciding on joining. When a company has the best group health insurance plan that its competitors don’t have, it will be able to keep more of its employees.

How Corporate Health Insurance Transfers While Job Change?

Corporate health insurance is a form of group health insurance that has an employer-employee relationship. Corporate health insurance is a form of group health insurance that has an employer-employee relationship.

Is Group Health Insurance Becoming More Affordable and Accessible?

Group health insurance is slowly becoming a necessity for most companies, regardless of size. The rising cost of healthcare makes it even more important. Every company needs to look after its employees, and purchasing group health insurance is more cost-effective than asking employees to avail of their own individual health plans. The good news is […]

Your Guide to Voluntary Top-Up in Group Health Insurance

The group health insurance voluntary top-up option is one such way in which insurance companies provide flexibility in their group plans. Earlier, group plans used to be highly rigid and one-size-fits. However, these days, insurance plans have become much more sophisticated and better at solving the needs of users.

Top 5 Health Insurance Companies in India 2022 (in terms of claim settlement)

The claim settlement ratio of personal health insurance is the number of health claims settled to the number of health claims received by the insurance company. The health insurance claim settlement ratio depends on the number of claims settled by the insurance company compared to the number of claims received by the insurance company during […]

Group Health Insurance Glossary:

The insurance industry has a lot of jargon that people need to know about. These terms are commonly used by industry insiders, however, most people outside the industry don’t know what it means. If you’re looking for group health insurance, then you should know about the following group health insurance glossary before deciding on a […]

Things to Consider While Buying Group Health Insurance for a Construction Company

Every type of company has its own requirements when it comes to health insurance. Some companies are relatively high risk when compared to other companies. A high-risk company is a company whose employees operate under less safe working conditions when compared to other companies. A construction company is considered to be relatively high-risk because accidents […]

Top Healthcare Benefits in Group Health Insurance

As the name suggests, a group health insurance policy is a policy that covers several people. A group health insurance policy can be availed by companies for their employees or by organizations for their members. Usually, companies offer health insurance to their employees as one of the perks and benefits of working with them. Group […]

What is Corporate Buffer in Group Health Insurance?

A group health insurance policy can be availed by companies for their employees. It is one of the most common benefits offered by corporates to their staff. Availing of a group policy has several benefits and advantages which are not available in an individual or family policy. The corporate buffer is one such benefit. In […]

Top Reasons Why Employees Don’t Use Group Health Insurance

As an employer, you may be considering offering a group health insurance to your employees as a benefit. Why is group health insurance important? There are several advantages of offering group health insurance such as better employee retention, higher goodwill in the market, improved productivity of employees, and so on. A group health insurance is […]

What are the Types of Endorsement Scales in Group Health Insurance?

An insurance policy is not set in stone. There are several circumstances in which the terms and conditions of an insurance policy may need to be changed. Some of the reasons may include a change in the relationship between the proposer and the insured, a change in the details of the nominee, an addition or […]

What is Capping or Sub-Limit in a Group Health Insurance Policy?

Before opting for a group health insurance policy, employers need to be aware of and familiar with the terms and conditions of the policy. There are several details in a policy which may seem minor but can have far-reaching consequences. It is better to go through the policy document carefully so that there are no […]

What is the difference between employee compensation and employee benefits?

What is the difference between employee compensation and employee benefits? Compensation: Compensation is a monetary or non-monetary consideration given by an employer to an employee for his or her work in the organization. Compensation is pre-agreed rumination and part of CTC, and the organization can change the structure over time. Employee compensation can either be in […]

Have you Noticed this Condition in your Health Insurance Policy?

All you need to know about pre-existing diseases in Health Insurance. Pre-existing diseases are diseases that the policyholder already suffers from before purchasing a personal health insurance policy. This policy condition determines playability in a majority of health insurance claims. Must Read – What are the Benefits of Super Top Up Health Insurance Plan? As per […]

Top Insurance Companies of Workmen Compensation Policies in India

What is it? The Workmen’s compensation policy is a type of liability insurance policy which covers the legal liability of the employers under the Workmen’s Compensation act, 1923, and Fatal accidents act,1855. The act was passed to provide monetary compensation to the employees injured at the workplace. The act specifies that the employer will be […]

Top Insurance Companies of Group Health Insurance Policies in India

What is Group Health Insurance? Group health insurance is a type of health insurance policy that provides health insurance coverage to a group of members under a single policy. The policy compensates the insured members of the policy up to the sum insured limit mentioned under the policy in return for a premium amount. Group […]

Group Health Insurance Exclusions – List of Things Not Covered for Employees

Group health insurance compensates the hospitalization and other related expenses of the insured members up to the limit mentioned under the policy terms and conditions in return for an amount known as premium. The premium under the group health insurance policy is mostly paid by the employer and employee gets to avail of the health […]

What to Do If Health Insurance is Not Affordable?

Let’s think deeply about whether it’s easy to pay yearly premiums or an uncertain, massive medical bill at the hospital, which can affect your lifestyle for a very long time. A lung cancer surgery can cost you around ₹ 3 lakhs and, in addition to that around ₹ 27000- ₹42000 per cycle. Similarly, the average […]

20 Lakhs Health Insurance At Just 2k For Your Family

20 Lakhs Health Insurance At Just 2k For Your Family Recommended Post Best Health Insurance Policy in India

When Should You Get a Group Health Insurance Policy for Your Employees?

Group health insurance is the best form of providing health insurance coverage to employees by any employer. The group health insurance policy would be taken by the employer of the organization to provide health insurance coverage to their employees in case of hospitalization due to the illness, disease or accidents. The maximum liability of the […]

Get a Health Insurance cover of 1 Cr at just Rs. 12K for Self , Spouse & 1 child.

There are a lot of new inventions in the health care sector with developments in science & technology. Robotic surgeries are soon going to be a common process of treatment in the future. It will be possible that the doctor or the specialists need not be physically present with the patient. There will be less […]

3 options for the high Treatment cost of Covid

Worried about the high Treatment cost of COVID? Here are the 3 options you have Option A: Ask for an additional Corporate Floater from the Same Insurer Any claim crossing the normal sum insured can be paid from this corporate Floater. You should have a minimum of 40 lacs buffer, for a group size of […]

Gift Your Spouse “Health Insurance” this Karwachauth

I walked into my bedroom, after my dinner and a stroll. It is already past 8 PM. My wife, Sharada (Saru, as I lovingly call her) also would have retired by now. As I entered, I saw my Saru standing at the fully open French window, gazing at the moon, with wide-open arms, as if […]

Does Group Insurance Cover Pre-Existing Conditions?

Group health insurance is a type of health insurance policy that covers the hospitalization expenses of a group of members under a single master policy in return for a nominal amount known as Premium. The group health insurance policy is usually taken by an employer for their employees and the premium is paid by the […]

Why should you invest in group health insurance?

Group health insurance is a type of health insurance policy that covers the hospitalization and other related expenses of the insured members of the policy in return for a premium amount. Most of the group health insurance policies are taken by the employers to cover their employees working in their organization. Organizations provide group health […]

Health Insurance for Smokers: Impact of Tobacco Consumption on your Health Insurance

It is widely believed that people who consume tobacco and other related products would not get any life and health insurance coverage from insurance companies. This was the case a few years ago where the insurance companies used to deny insurance cover for people consuming tobacco and other related products. Insurance companies do offer health […]

Working model of Employee Funded (or Self Funding) Health Insurance in India

Health insurance is an agreement between the insurance company and the insured customer in which the insurance company agrees to settle the hospital bills of the insured customer up to the sum insured limit mentioned in the policy, in return for a nominal amount known as Premium. Insurance companies provide the insured customer with health […]

Sum Insured in Health Insurance Policies: Compare Personal and Group Health Insur

Group health insurance can be defined as a health insurance policy that provides financial compensation to the insured in case of hospitalization due to any of the illness or disease mentioned in the policy in return for a nominal amount known as a premium. The premium can be paid in one go or in installments. […]

List of Common Surgeries covered under Group Health Insurance for Employees and Their Parents

Surgery insurance coverage is a health insurance plan that covers the medical expenses of surgery. It is also known as operation insurance, which covers the cost Surgeries Covered Under Group Health Insuranceof surgical procedures required for the treatment of a medical condition or illness. Surgery is a medical or dental specialty that uses operative manual […]

Is treatment for Mental Health covered by Group Health Insurance policies?

Psychometrics refers to the field of psychology devoted to testing, measurement, assessment and related activities. Psychometric testing in psychology assists doctors in evaluating a patient’s learning, social, behavioral, and personality development. The results of the tests can help in treatment of the psychometric conditions of the patients. Psychometric treatment is the treatment for mental illness […]

Privatization of Public Sector General Insurers

A recent news article caught my fancy yesterday. The article was titled “One state run insurer might be privatized ahead of banks”. The article piqued my curiosity, primarily because one of my cousins who started his career in the Insurance Industry has made his millions there. While at it, he had offered me to join […]

Health Insurance Premium for Healthy people should cost zero!!!

Imagine you are a healthy adult of forty. You exercise regularly, and work hard towards maintaining a healthy lifestyle, despite your demanding work schedule. Do you ever wonder why you have to bear the same premium as someone who smokes, leads a sedentary lifestyle and doesn’t believe in the idea of exercising? Well, the good […]

Selling Public Sector General Insurers

Of late there seems to be a renewed sense of activity with public sector general insurers (PSIs)—offices are being amalgamated, and closed every other day; new incentive schemes aimed at cajoling employees into Sales & Marketing are the talk of the town. There seems to be a sense of urgency that colors the air. Could […]

Who is not Eligible for Group Medical Insurance in India?

Group medical insurance is a form of health insurance taken by a group of members under a single master policy. The group medical insurance would compensate the members in case of any hospitalization due to illness or disease up to the limit mentioned under the policy. The eligibility for group health insurance differs from one […]

Is Group Health Insurance Mandatory for Employees in India?

Group health insurance: Group health insurance compensates the employees in case of hospitalization due to illness or accident. Group health insurance would be given to a group for which the premium would be paid by the employer of the group. Group health insurance is usually taken by employers to cover their employees as a part […]